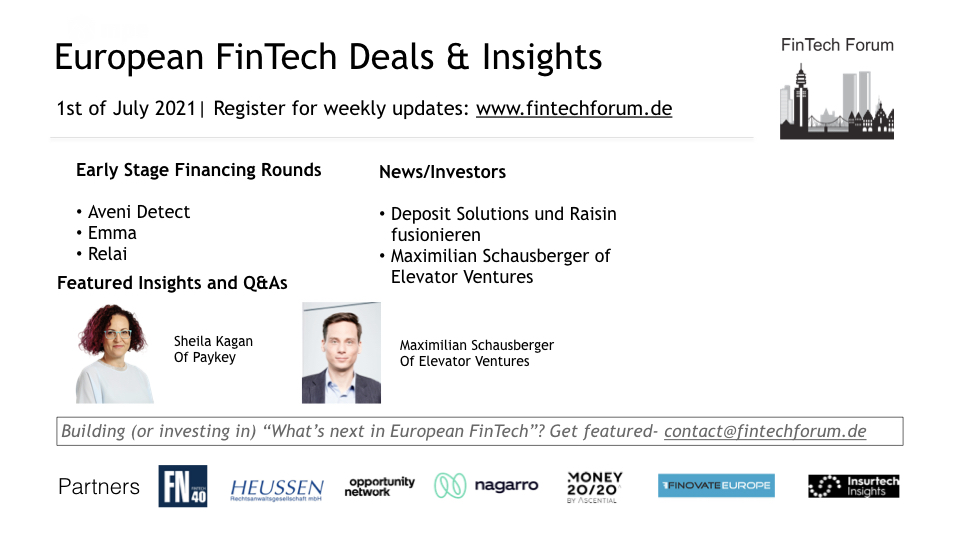

Early stage European FinTech deals include Aveni Detect, Emma, Relai etc. We feature Q&As with Sheila Kagan of Paykey and Maximilian Schausberger of Elevator Ventures.

If you are an early stage startup in Europe building the next big thing in FinTech, reach out to Frank Schwab or Samarth Shekhar.

Scaling Enterprise FinTech: with Sheila Kagan of Paykey

1.Tell us a bit about yourself and your company.

I joined PayKey in March 2020 after years of working as a chief executive at a variety of public and private tech companies in the advertising and gaming industries. Throughout my life I’ve been drawn to the dynamics of the banking industry, and once the opportunity came, I knew PayKey is a FinTech uniquely positioned to leave a mark on an industry that is traditionally lagging behind.

At PayKey we are putting banks at the forefront of embedded banking, by weaving the financial services customers need within their everyday lives. Our patented mobile keyboard

solution allows customers to access a variety of mobile banking services including P2P payments, loans, investments and more within all the social & messaging apps they are regularly using like WhatsApp, Instagram, Facebook and others. With our solution, banks can contextually bring their services to where customers today chat, transact, and make their financial decisions.

http://www.fintechforum.de/scaling-enterprise-fintech-with-sheila-kagan-of-paykey/

Scaling Enterprise FinTech: with Maximilian Schausberger of Elevator Ventures

1. A year since the first lockdowns- is this is a good time to be building or scaling an Enterprise FinTech (/InsurTech) firm in Europe?

Despite all the difficulties that 2020 has brought for entrepreneurs, some sectors have also benefited. We see Enterprise FinTech benefiting from an increased need for digitalization and for efficient operations in banking and insurance. As an example from the financial sector, Raiffeisen Bank International saw double-digit growth in its mobile banking users over the first half of 2020 (see here). This also creates many opportunities, which seem to have fueled investor appetite in 2020.

scaling-enterprise-fintech-with-maximilian-schausberger-of-elevator-ventures

These two Q&As are part of Scaling Enterprise FinTech | The Handbook, featuring Q&As on the journey to scale, lessons learnt etc. with 16 founders and 10 leading investors.

Aveni Detect Raises £1.1M in Funding

Aveni Detect, an Edinburgh, Scotland, UK-based provider of a speech analytics platform for financial services, raised £1.1m in funding.

The round was led by the TRICAPITAL Angel syndicate, supported by Scottish Enterprise’s Growth Investments, Old College Capital and Wallace Equity.

The company intends to use the funds to launch an AI tool to help identify vulnerable customers, move beyond financial services into other regulated industries, whilst building a team to support its UK expansion.

Led by Joseph Twigg, CEO, Aveni is to launch a platform which uses advances in AI and natural language processing (NLP) to automate processes direct from the customer voice.

aveni-detect-raises-1-1m-in-funding.html

Overfunding: Fintech Emma Secures £1.8M+ via Crowdcube, Is Developing Crypto, Credit Scores, Stock Trading Services

Emma, a company that’s on a mission to be the control center for your money, has secured £1,889,342 from 2,588 Investors (at the time of writing) via Crowdcube.

Backed by Connect Ventures and other leading VCs, Emma had a £1,000,000 fundraising target. Emma reports a £34 million pre-money valuation, a 5.26% equity, and a £1.75 share price.

The company’s management notes that they’re targeting 1 million customers by the end of 2021.

Relai Raises CHF 2.5M in Series A Funding

Relai, a Zurich, Switzerland-based bitcoin app, raised CHF 2.5m in Series A funding round.

Backers included Redalpine, Polytech Ventures, Fulgur Ventures and ACE & Company.

The company intends to use the funds to build a proprietary broker for efficient order processing and provide new offerings for investors looking to buy large amounts of bitcoin.

Led by Julian Liniger, CEO, Relai provides an app that enables users to invest in bitcoin within minutes, using their own bank account and without additional deposits or registration.

https://www.finsmes.com/2021/06/relai-raises-chf-2-5m-in-series-a-funding.html

Italy’s Young Platform nabs €3.5 million to simplify access to the world of cryptocurrencies

Young Platform, a new platform that simplifies access to the world of cryptocurrencies, has announced raising €3.5 million in a Series A round. United Ventures, the Italian venture capital firm specializing in investments in digital technologies, is the lead investor, with a pool of select Italian and international investors and business angels, including Ithaca Investments, Accel scout Luca Ascani, Max Ciociola, and Pietro Invernizzi, also participating.

Founded in 2018 by six Computer Science students from the University of Turin sharing a passion for blockchain technology since high school, Young Platform aims to simplify access to the world of cryptocurrencies through a hub of digital products. Young Platform is aimed at meeting the needs of different segments of users, from beginners to experts.

Hawk AI Raises USD$10M in Series A Funding

Hawk AI, a Munich, Germany-based software platform for banks, payment firms and fintechs for the detection of transactions linked to financial crime, raised $10m in Series A funding.

The round was led by BlackFin Capital Partners with participation from Picus Capital.

The company intends to use the funds to strengthen its European and U.S. presence, while also expanding to Singapore and the United Arab Emirates, as well as to double its employee headcount by the end of 2022.

Founded in 2018 by Tobias Schweiger and Wolfgang Berner, who both previously held senior leadership roles at PAY.ON (sold for $200M USD) and ACI Worldwide, the global payment systems company, Hawk AI provides a software platform for banks, payment firms and fintechs for the detection of transactions linked to financial crime.

https://www.finsmes.com/2021/06/hawk-ai-raises-usd10m-in-series-a-funding.html

French insurtech Hoggo raises €11 million

I sometimes wonder if the legal, insurance, and New York City alternate parking rules are intentionally confusing. This is an oxymoron, as of course they are. But France’s Hoggo is seeking to change that. Residents will now be able to park on … oh no wait, they’re bringing insurers, accountants, and companies all to the same table and simplifying the game, to the benefit of all.

With an €11 million raise headed up by Partech and participation from GFC (Global Founders Capital), Hoggo is helping companies optimise and simplify the management of their health and risk contracts via a single platform, regardless of the insurer.

https://tech.eu/brief/french-insurtech-hoggo-raises-e11-million/

Kaiko Closes $24M in Series A Funding

Kaiko, a Paris, France-based cryptocurrency market data provider, raised $24m in Series A funding.

The round was led by global financial services investors Anthemis and Underscore VC with participation from Point Nine, Alven and Hashkey Capital. In conjunction with the funding, Sean Park, Anthemis founder and experienced capital markets executive, will be joining Kaiko’s board. Underscore VC’s founder and market data infrastructure investor, Richard Dulude, will also be joining the board.

The company intends to use the funds to continue hiring in the areas of product, institutional sales, business development, and engineering and support expansion into North American and Asian markets.

Led by Founder and CEO Ambre Soubiran, Kaiko aims to serve as a single source for consolidated financial market information.

https://www.finsmes.com/2021/06/kaiko-closes-24m-in-series-a-funding.html

Smart Raises £165M in Series D Funding

Smart, a London, UK-based global retirement savings technology platform provider, raised £165m in Series D funding.

The round was led by Chrysalis Investments, with a £75m equity investment, with additional investors to be announced in the coming weeks. The overall round will comprise £110m of primary and £55m of secondary equity.

The company intends to use the funds to further grow its retirement technology platform offering in the UK, the US, Australia and the Middle East, with additional territories to follow,

Co-founded by Andrew Evans and Will Wynne, Smart is a global savings and investments technology platform provider.

https://www.finsmes.com/2021/06/smart-raises-165m-in-series-d-funding.html

ClearScore Raises $200M in Funding

ClearScore, a London, UK-based credit marketplace, raised $200M in funding at a valuation of $700m.

Invus Opportunities made the long term investment, which is a mix of primary and secondary, with existing investors – QED, Blenheim Chalcot and LeadEdge – together with management, retaining the majority of their positions in ClearScore. Benjamin Tsai of Invus Opportunities joined the ClearScore board, with co-founders Nigel Morris remaining as Chairman and Justin Basini continuing as Chief Executive.

The company intends to use the funds for ongoing investments to expand its team, product suite, and customer base globally.

Led by Justin Basini, co-founder and CEO, ClearScore is a free credit score and financial product marketplace.

clearscore-raises-200m-in-funding.html

Deposit Solutions und Raisin fusionieren

Die einstigen Rivalen verschmelzen. Außerdem: Buzzfeed geht über Spac an die Nasdaq und Confluent legt erfolgreichen IPO hin.

Zwei der größten deutschen Fintechs, Deposit Solutions und Raisin, schließen sich zusammen. Die ehemaligen Konkurrenten verschmelzen zu Raisin DS. Monatelang wurde das Vorhaben geheim gehalten und nun letzten Freitag abgeschlossen. Das Fintech will international, vor allem in den USA, wachsen und europäischer Marktführer werden. Es ist die erste Fusion zweier großer Fintechs aus Deutschland.

Zwei der größten deutschen Fintechs, Deposit Solutions und Raisin, schließen sich zusammen. Die ehemaligen Konkurrenten verschmelzen zu Raisin DS. Monatelang wurde das Vorhaben geheim gehalten und nun letzten Freitag abgeschlossen. Das Fintech will international, vor allem in den USA, wachsen und europäischer Marktführer werden. Es ist die erste Fusion zweier großer Fintechs aus Deutschland.

Radical change requires a radical catalyst. Fintech has a big journey to go on, and Money20/20 Europe is here to help you take the first big leap into the unknown.

This is the only place where the whole community, from payments to banking to retail to regulation and beyond, comes together to make the decisions that shape the future.

This September, get ready for a reimagined Money20/20 Europe experience that puts you in the driving seat. The conversations that take place here will decide our collective trajectory.

CTA – Buy your pass

URL – https://bit.ly/2TjdoEQ

Meet us at:

Viva Technology, 16-19 Jun. 2021, Paris https://vivatechnology.com

4YFN, 28 Jun. – 01 Jul. 2021, Barcelona https://www.4yfn.com

InsurTech Insights, 1-2 Sep. 2021, London https://www.insurtechinsights.com/europe/

Money2020 Europe, 21-23 Sep. 2021, Amsterdam https://europe.money2020.com

Meet Our Partners:

Heussen https://www.heussen-law.de

Nagarro https://www.nagarro.com/en

Opportunity Network https://www.opportunitynetwork.com/fintech-forum

Money2020 Europe https://europe.money2020.com

InsurTech Insights https://insurtechinsights.com

Finovate Europe https://informaconnect.com/finovateeurope/

FN FinTech 40 https://www.fnlondon.com